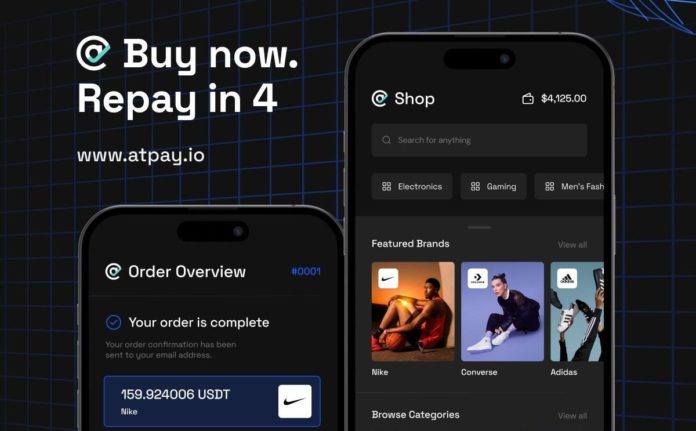

Fintech disruptor @Pay has announced their listing of their token ATPAY on MEXC and Raydium this Monday at 10 am UTC. The app will begin launching to merchants and customers in Q4 2022. @Pay is a DEFI (Decentralized Finance) protocol that is the first BNPL (Buy Now Pay Later) platform built to integrate blockchain technology with its own cryptocurrency. @Pay is one of the largest projects in the DeFi space aiming to power millions of real-world transactions while taking on the multi-trillion dollar payments industry.

About ATPAY token

The @Pay token (ATPAY) is a Solana (SPL) based asset. The SPL token framework will allow a fast, scalable and efficient structure for the distribution, support and functionality of the native token.

The @Pay token is the token that powers the @Pay integrated rewards program available to all users that successfully complete their repayments in a timely fashion. The @Pay token can be used in various ways such as buying into a higher credit limit, used as currency to purchase products and services from @Pay merchants in the @Pay marketplace and, in time, able to vote on certain outcomes that can shape the outcome of the @Pay platform.

Token listing metrics:

- Listing will commence on 12 September 2022 at 10:00 am UTC on MEXC

- Total Token Supply 300 million

- Circulating Supply 100 million with the majority held by @Pay and subject to lock-ups. with the majority held by @Pay and subject to lock-ups.

From the date of distribution, ATPAY token holders with 200,000 or more tokens will be locked. These tokens will be unlocked annually as per the following schedule:

- 10% of the total @Pay tokens held by an owner will be unlocked 31 Dec 2022.

- 10% of the total @pay tokens held by an owner will be unlocked 31 Dec 2023.

- 40% of the total @pay tokens held by an owner will be unlocked 31 Dec 2024.

- The remaining balance of the total @pay tokens held by an owner will be unlocked 31 Dec 2025.

About the Project

@Pay aims to become a first of its kind platform for BNPL solutions, combining three emerging markets; Buy Now Pay Later (BNPL), Crypto and Traditional Currency, and Blockchain and Smart Contracts.

@Pay is taking on the global payments and BNPL industry which is projected to reach 233 billion by 2025* (consensus.gov). Even if it only takes 1% market share; annual turnover could reach $2.3billion USD. That’s hundreds and thousands of transactions powered by @Pay’s blockchain technology.

@Pay aims to be a key participant in offering decentralised finance (DeFi) eCommerce and in-store solutions to shoppers & merchants. @Pay will also allow users to pay for their shopping with any traditional currency (fiat) or approved cryptocurrency they hold in their wallets. Shoppers and merchants will be rewarded with tokens for all transactions and repayments. This places @Pay in the unique position to become the premier BNPL solution for gaming platforms, esports, NFT marketplaces, Web 3 businesses whilst also targeting traditional BNPL merchants.

@Pay has also already signed up over 500 affiliate merchants. This includes major retailers such as adidas, Calvin Klein, JD Sports, North Face, Dior, F1, Fanatics, Coach, GAP and Lacoste amongst others. This is in addition to industry partnerships such as MetaRun, Fomolabs, Algorand, Solana and more. Other key partnerships in the works include Binance Pay and global football clubs.

Further, @Pay has developed its own APis allowing @Pay to be easily integrated into merchant payment gateways giving it access to thousands and thousands of merchants around the World.

Here’s a summary of what users can expect of this unique ecosystem that stands out from its competitors:

- Pay with Cash or crypto

- Buy now – Repay in 4 instalments

- No interest or late fees

- Earn rewards for completing repayments on time

- Earn rewards in crypto

- Stake

The @Pay protocol and app will earn revenue in 4 key ways:

- Merchant fees for BNPL – a merchant pays @Pay 4-8% of every transaction when a shopper chooses to purchase a good or service using the BNPL feature.

- Affiliate merchants’ payments. @Pay receives 5-10% of the transaction amount for driving shopper traffic..

- Monthly account keeping fee of $8 payable by anyone that has repayments outstanding from using the BNPL feature..

- Crypto Pay transaction fees – 1% fee of the transaction amount.

All this is made possible by launching and growing usage of our app. The app will begin launching to merchants and customers in Q4 2022. A single app for shoppers and retailers to manage all their crypto and cash payments seamlessly. Switching between cash and crypto is as easy and fast as changing channels on your tv. It’s a little bit of @Pay magic.

Alongside the app launch, @Pay business is set to launch in October; unlocking the ability for businesses across Australia and overseas to be able to accept cash payments in store and have these converted into crypto, instantly. @Pay business will be great for professionals (doctors, lawyers, accountants, beauty therapists, tradespersons etc..

Then we are rolling out with crypto BNPL late this year, followed by a virtual card early next year. Jump on in early into this thrilling project!